Subprime, CDO, Recession = Who Cares

There's never been a better way to find out what people are thinking about than Google Trends. It's like a global vox pop at your finger tips.

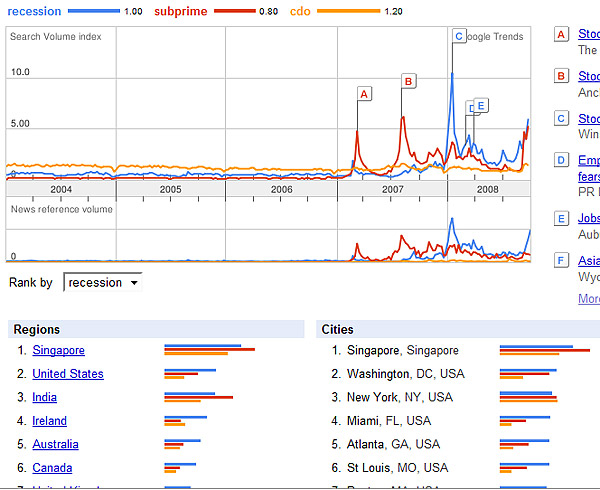

Check the rising searches for recession, subprime and CDO. All related to the financial mess we are in. Dire straights? Looks like Singapore is screwed too judging by the number of searches.

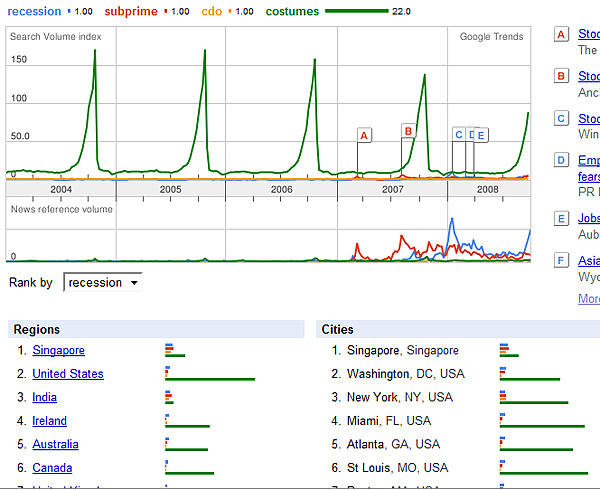

But then compare this to searches for costumes...... um look like it's business as usual for most people. "We might lose the house but fuck it.. we're not going to let that ruin Halloween!"

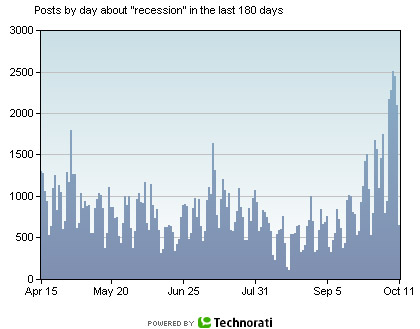

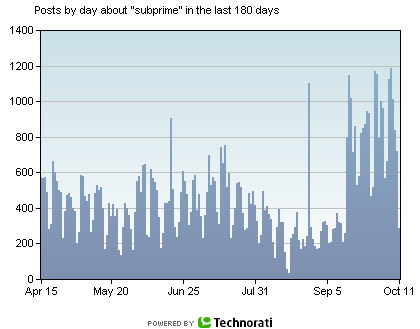

Technorati also allows you to easily chart posts on certain keywords too. Recession and subprime posts have all increased.

All this search traffic and confusion about financial elements that make no sense creates a real opportunity for people who know WTF is going on to step in an explain it in layman's terms.

A forward thinking financial institution can use this time to try and explain it to consumers rather than push their standard messaging. And in doing so create some trust and worth behind their brand besides having the lowest interest rate. There might already be examples of this I've missed?

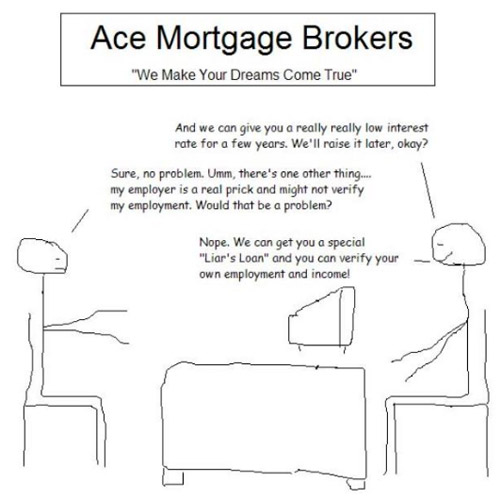

There's already been a few PPT files flying about explaining some aspects in a humorous way. Like the Subprime Primer which you can read in full on Google Docs

Or if you need this explained by the Aussie comedy duo (usually seen at the end of 60 minutes here in Aus) watch here.

Or if you want to be even more confused about the future economic situation (hint: it's not good) check this presentation from Sequoia Capital (the guys who backed Google). Thanks Valleywag for the tip.

And lastly this type of situation is best explained through video like the one below. This was found on an NPO's channel.

Xplane, a company which specialises in this type of communication (and one of my fav companies around) has their Xplanation video online too. They sent this around to their mailing list. Although I found the champagne video easier to follow as to why it all went tits up.

Watching all these presentations has cleared up a lot for me. I'm still confused why the USD is going so strong lately but I'll wait for a video to explain it to me easily than read pages of boring jargon.

How does this financial situation affect the digital market worldwide and especially here in Australia? I'm hoping it means more money goes into online and less in traditional (seems obvious).

It also means the listed digital agencies will have a hard time raising more capital. BlueFreeway's recent "3 for 1 renounceable rights issue" will be a hard sell when everyone is trying to keep hold of their cash. And even harder sell when you look at the stocks recent performance. For those interested you can read the prospectus here.

Note: Bannerblog are not financial advisors nor do we have any idea how the financial system works. See a registered financial advisor for proper advice before throwing your money away.